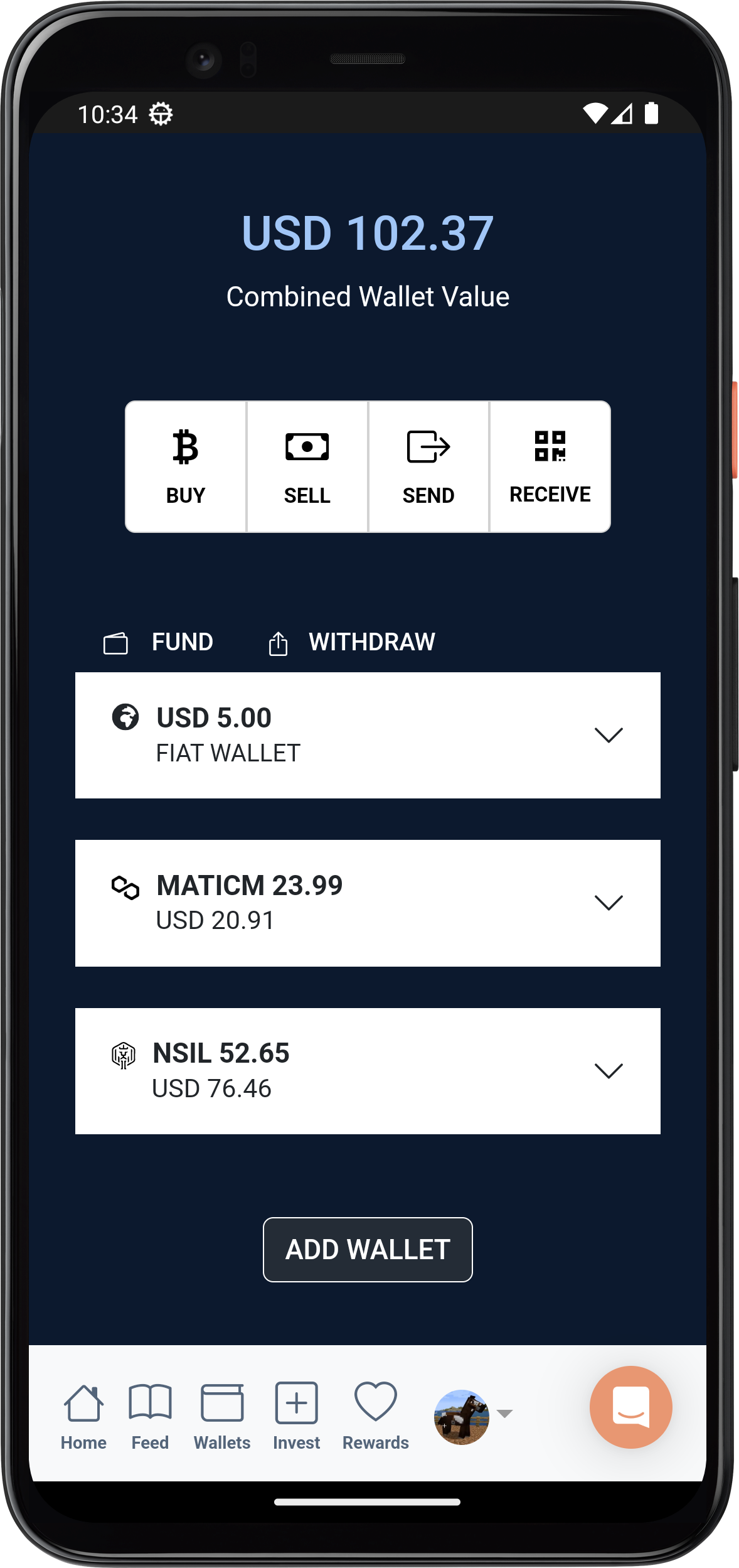

The easiest single destination to invest across Asset Classes and Geographies. For next generation investors.

Our investment platform (TIGR) leverages Web3 technology to tokenise Asset Classes (incl. Crypto) across Geographies, broadening access to time-tested wealth creation opportunities via pioneering products and services that sit at the intersection of Asset Management, Investment Banking and Payments.

CONSILIENCE 10|10 –

The world’s first on‑chain split‑crypto index product

CONSILIENCE 10|10 –

The world’s first on‑chain split‑crypto index product

A tokenised index product that combines the benefits of ERC-20 tokens and a traditional index into a hybrid product which constitutes the Top 10 Crypto and Top 10 DeFi assets.

Token holders gain diversified, passive exposure to top Crypto and DeFi assets, weighted by market capitalisation i.e. a single NSIL 1010 Token facilitates investment in 20 cryptoassets. Passive exposure means that other than rebalancing at pre-defined intervals and rules, there is no active trading. This enables token holders to cost effectively track the mean performance of the Crypto and DeFi markets.

Launch Platform

Launch Platform

TIGR‑Markets Financial news, insights, and learning in just 5 minutes

People

Altesh BAIJOO

Chief Executive Officer, NSIL Committee

INSEAD MFin, University of Stellenbosch MPhil

South Africa

Altesh gained his Business Management practical know-how via working at multi-national companies and at high growth early-stage companies, and via growth and exit of his own consulting and media business. He gained his Corporate Finance and Investment Management practical know-how via working at high growth early-stage FinTech companies, including a Direct Lending Platform, Licensed Stock Exchange and a Private Debt Marketplace, the latter which he was the Founding Managing Director of. He also established his own investment holding company through which he continues to apply his corporate finance and investment management know-how.

Benito GRIMAUDO

Global Advisory Board

Sawyer Business School MBA

Italy, South Africa

Benito is an Italian national who now lives and works from Johannesburg. He previously lived in the U.K, the U.S. and Kenya. He has 20+ years of Investment Management experience, specifically as it relates to energy and infrastructure. His experience includes stints at the IFC and AfDB, with more than US$ 3 bn of executed project value across 15 African countries. He was also a founding executive of the ARM-Harith Infrastructure Fund; a US$ 250 mn closed-end African infrastructure fund. Most recently he and his business partner announced the close of their inaugural “Green Fund I” via Fortis Green Renewables.

Christo HOLTSHAUSEN

Non-executive Director, NSIL Committee

University of Stellenbosch MBA, PrEng, MIEAust

Australia, South Africa

Christo gained his Engineering and Product Management practical know-how via working at multi-national companies and government organisations, as well as his own early stage and consulting companies. Also through his post graduate education which focused on Innovation Management. Christo is a registered professional engineer in both South Africa (PrEng) and in Australia (MIEAust), as well as a member of the South African Institution of Mechanical Engineering and University of Stellenbosch Business School (USB) Consulting Club.

Jing LI

Global Advisory Board

London Business School MBA, Columbia University MPA

China, South Africa

Jing is a Chinese national who also works from Johannesburg, having previously lived in the U.S., Tunisia, Cote d’Ivoire, and U.K. She has 13 years of investment experience in infrastructure, with the World Bank and the African Development Bank. She has successfully originated, structured, negotiated and executed 15 project finance and corporate finance transactions mainly in the energy and transportation sectors, across 17 African countries with a deal value in excess of US$1.3 billion, involving equity, debt, grant, blended finance, syndications, guarantees and advisory services.

Michael KOSIC

Global Advisory Board

INSEAD MBA, PEng

Canada

Michael Kosic is a Managing Partner of Loyal VC, founded in 2018. Loyal has invested in 250+ companies, in 50+ countries while delivering top quartile financial returns, thanks to its network of 700+ expert advisors. Loyal draws on Michael’s lifelong experience as a technology entrepreneur, professional Industrial Engineer, and Angel Investor, while heavily leveraging his INSEAD network, where he earned his MBA, and the Founder Institute accelerator, where he was a top rated mentor for several years.

Miloš PERDUH

Global Advisory Board

University of Balgrade MEng Structural

Serbia, South Africa

Miloš graduated in 2009 with a degree in civil engineering, and subsequently obtained a Master’s degree in structural engineering. Miloš has worked as a Structural Engineer in Europe, Unites States, the Middle East and Africa, and gained a broad range of experience working on various project across different industries. Miloš’s technical and leadership skills align very well with our goals to facilitate socio-economic development via infrastructure development, which skills we will access via his participation as a member of our Global Advisory Board.

Richard LIAO

Global Advisory Board & NSIL Committee

INSEAD MFin, CFA

Singapore

After graduating from NTU, Richard has enjoyed a number of roles in the finance sector ranging from investment banking (focusing on M&A) to corporate banking (specialising in loans and commodity trade finance). Richard is presently the director of a fintech company that develops private exchange for commodity trade and supply chain assets. Richard’s wealth creation philosophy is about being prudent and knowing the risks before making an investment decision. By managing the risks, he believes it’s possible to limit the downside and let the upside take care of itself.

Simone THOMPSON

Global Advisory Board

INSEAD Advanced Management, Harvard Business School Behavioural Economics, University of Birmingham LLB Honors

Switzerland

Simone spent her career to date working in finance in a wide range of positions. During her last five years she was Chief of Staff to the President of UBS Wealth Management, heading the Executive Office as well several cross-bank strategic programs. Her prior experience includes roles at Zurich Financial Services, Unilever, and Young & Rubicam, and a number of board positions over the past 10 years. Simone's experience has enabled her to refine her skills in marketing, sales, operations, business development, project management, cultural change and fundraising.

Thabo LIMEMA

Global Advisory Board

INSEAD MFin

South Africa

Thabo's passion for finance emerged at a young age, which led to him participating in an investing competition hosted by the Johannesburg Stock Exchange (JSE) followed by vacation work at Investec and Ninety One. He subsequently acquired foundational technical skills via his undergrad accounting specialisation, then broader corporate finance skills via an Executive Masters in Finance. His career experience spans thirteen years, across multiple markets including South Africa, the UK and Mauritius, in various finance, operational and sales roles at one of South Africa’s largest financial institutions, Absa Group Limited.